Day trading is a daily base trading. You can trade every day and can make profit every day with using this strategy. Day trading involves active trading where investors buy and sell stocks or assets based on short-term price movements.

However, it’s important for investors Magic Indicator to understand that day trading carries significant risks, and there’s a high probability of incurring losses. Instead, day traders hope to capitalize on short-term gains, often executing multiple trades within a single day.

Day trading Rules for Beginners

It’s typically contrasted with the buy-and-hold strategy commonly employed by long-term investors. In day trading, the focus isn’t on long-term profitability.

Day trading entails short-term trades conducted daily or weekly to achieve returns. Day trading is a self-directed form of active investing, where traders execute their strategies independently. Contrary to long-term investors who prioritize a company’s Ease of Movement Indicator growth potential, day traders are more concerned with exploiting price volatility for immediate gains.

The Securities and Exchange Commission (SEC) defines day traders as individuals who buy, sell, and short-sell stocks throughout the day, hoping to profit from short-term price movements.

Common Day Trading Strategies beginners PDF

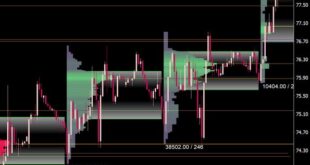

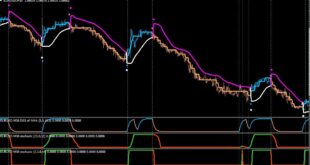

- Technical Analysis: you can use price patterns to forecast future movements, technical analysts focus on support and resistance levels to make trading decisions.

- Swing Trading: Capitalizing on short-term price momentum, swing traders combine fundamental and technical analysis to identify trends.

- Momentum Trading: High-risk strategy involving short-term trades to profit from price trends.

- Scalp Trading: Profiting from small price changes by executing quick buy and sell orders.

- Penny Stocks: Trading low-priced stocks, Kolier SuperTrend typically outside major exchanges, which can be volatile and risky.

- Limit and Market Orders: Using predefined price levels for buying or selling stocks.

- Margin Trading: Borrowing funds from a broker to increase trading capital, accompanied by higher risk.

Best Securities for Day Trading:

Day traders can trade every day with using all assets, including stocks, ETFs, bonds, currencies, cryptocurrencies, commodities, options, and futures.

Liquidity, volatility, and volume are essential factors in selecting trading instruments.

Day Trading Basics Getting Started:

Day trading mean trader can trade every day in working days. Day trading, investors should determine their risk tolerance and start with a small investment. Staying informed about market events and familiarizing oneself with trading terms and concepts is crucial.

Risk Management in Day Trading:

Risk management is very important thing because forex trading market is very risky market. Managing risks is paramount in day trading.

Investors should avoid investing more than they can afford to lose Chandelier Exit monitor volatility, stick to a trading strategy, and control emotions to avoid impulsive decisions.

Making Money in Day Trading:

Success requires discipline, experience, and professional-grade tools. New traders should practice and understand the complexities before venturing into day trading. While it’s possible to profit from day trading, it’s challenging and risky.

Day trading can offer opportunities for short-term gains, but it’s best for investors to approach it with caution, discipline, and a thorough understanding of the risks involved. You can make profit every day. If you are expert and can manage your trading risk.

Forex MT4/MT5 Indicators Forex Indicators Download

Forex MT4/MT5 Indicators Forex Indicators Download