BOS stands for “Breakout of Support.”. This is a term used to describe the settlement process between buyers and sellers of currencies. The BOS is an agreement between the two parties that sets out rules and procedures for resolving disputes between them.

It’s important to know about the BOS Volatility Ratio because it can affect your trading strategies in a number of ways. For example, if you’re selling currencies and want to ensure that you receive your money as quickly as possible, you’ll need to follow the BOS settlement process. Likewise, if you’re buying currencies and want to make sure that you receive the best possible deal, you’ll need to be familiar with the settlement rules set out by the BOS.

What is Breaks Of Structure (BOS)?

Bos may be used in spot trading, where currencies are bought and sold immediately, or it may be used in forward contracts, where a trader agrees to purchase a currency at a specified rate on a future date. When using bos in spot trading, Price Action traders will need to factor in the current bos rate when making their decisions about whether or not to buy or sell a currency.

The term ‘bos’ is also used to refer to the value of a currency in relation to other currencies.

How to use BOS in Forex?

For example, if the euro is buying US dollars at a bos rate of 0.8%, then $1 equals €0.08 in terms of euros. In forex, the term “bos” stands for “Breakout of Support. When you say “I’m going to buy bos,” you’re indicating that you plan to purchase Richest Company the currency at a given price. When you say “I’m going to sell bos,” you’re indicating that you plan to sell the currency at a given price.

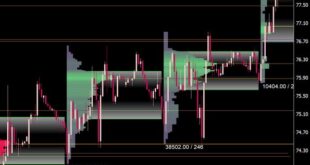

BOS (Breakout of Support.) is a function in Forex that calculates the average size of buy orders placed by a trader over a specified period. This figure can be helpful in identifying traders who may be trying to manipulate the market. BOS is a good indicator of market sentiment and can be used to help identify oversold or overbought conditions.

What does BOS mean in Forex strategy

BOS (Breakout of Support.) is an abbreviation Accurate Stock Indicator for the term “Breakout of Support.. The BOS also provides a financial service industry with a number of banks and other financial institutions. This industry contributes significantly to the economy of the BOS and helps to support jobs on these islands.

Forex traders use the BOS as a location for arbitrage opportunities. Arbitrage is the practice of buying and selling an asset in order to make a profit.

Forex arbitrage opportunities arise when the price of one currency is different from the price of another currency. For example, if the euro is trading at 1.30 US dollars, a forex trader might buy euros and sell US dollars in order to make a profit.

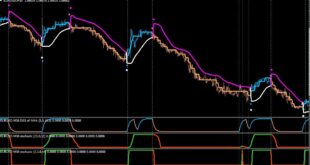

Forex MT4/MT5 Indicators Forex Indicators Download

Forex MT4/MT5 Indicators Forex Indicators Download