The Supertrend Indicator a combination of price action and volatility, making it a reliable indicator for determining market direction. The period refers to the number of bars used in calculating the trend while the multiplier determines how tight or loose the trend line will be.

A higher multiplier will result in wider trend lines, allowing for more flexibility but also increasing the chances of false signals. One of the main advantages of using the Supertrend Indicator is its ability to adapt to changing market conditions.

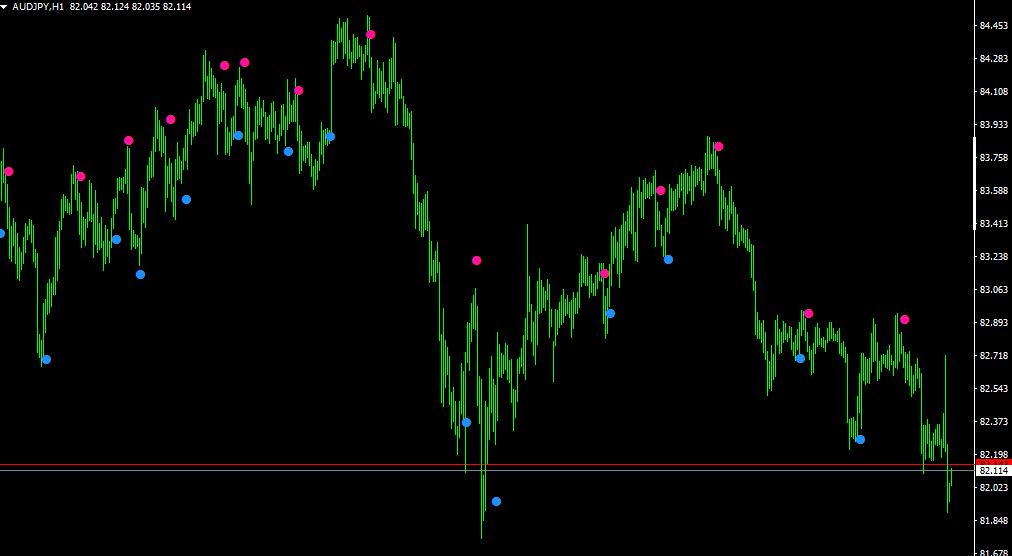

Super Trend Signal Buy Sell

The indicator itself consists of two main lines the Supertrend line and the Signal line, along with a series of dots that represent support and resistance levels. The Supertrend line is the primary signal generator and acts as a trend identifier.

It typically appears as a continuous line on the chart, Trend Magic either above or below price action, depending on whether it indicates an uptrend or downtrend. When the Supertrend line is green, it suggests an uptrend, while a red Supertrend line indicates a downtrend.

How to use the SuperTrend indicator

The Signal line serves as a confirmation indicaor for traders to enter or exit positions. It appears as small crosses above or below the price action and can change color from green to red (and vice versa) depending on market conditions. A green Signal line confirms an uptrend, while a red one signals a possible reversal in trend.

The Supertrend indicator uses volatility-based calculations best supertrend settings for 15 minutes chart to track price movements and check trends.

This makes it particularly useful in volatile markets where traditional indicators may not be effective. If both lines are moving upwards (Supertrend above Signal), it suggests strong bullish momentum in the market.

Conversely, when both lines are moving downwards DDFX Major Trend (Signal above Supertrend), it indicates bearish sentiment. A bullish crossover occurs when the Signal line crosses above the Supertrend line while a bearish crossover happens when the opposite occurs – with significant implications for trading strategies.

Tips for Supertrend indicator

The Supertrend indicator to your chart is not enough to guarantee success.

1. Understand the Basics of the Indicator:

it is important to have a good understanding of how it works. The Supertrend is based on two main components Average True Range (ATR) and Moving Averages (MA). ATR measures volatility while MA calculates an average price over a specified period.

It is crucial to understand these concepts as they form Half Super Trend the basis of the indicator’s calculations.

2. Use Multiple Time Frames best supertrend settings for 15 minutes chart

One common mistake that traders make when using indicators is relying solely on one time frame.

This can lead to false signals and missed opportunities. To avoid this, it is recommended to use multiple time frames when analyzing with the Supertrend indicator. For example, if you are trading on a 1-hour chart, also look at the 4-hour or daily chart for confirmation.

3. Combine with Other 3 supertrend strategy

While the Supertrend can be effective on its own, combining it with other indicators can provide more reliable signals. Some popular indicators that work well with the Supertrend include MACD, RSI, and Bollinger Bands. These indicators can help confirm trend direction and check entry points.

Forex MT4/MT5 Indicators Forex Indicators Download

Forex MT4/MT5 Indicators Forex Indicators Download